Using Bitcoin or other cryptocurrencies requires a digital wallet for transactions, trading on crypto exchanges, or utilizing blockchain applications. Consequently, understanding how cryptocurrency wallets function and the primary distinction between non-custodial and custodial wallet providers is crucial.

How Crypto-Wallets Work

Crypto wallets enable interaction with blockchain networks, allowing users to send and receive cryptocurrencies or access decentralized applications (DApps). These wallets comprise two main components: a public key and a private key. Wallet addresses are generated by the public key and can be shared, while private keys must be kept secret to ensure the funds’ security.

Crypto wallets can be paper, desktop software, or hardware devices, with some supporting non-fungible tokens (NFTs). Wallets are categorized as custodial or non-custodial, depending on how they store and manage the private keys.

Wallet Definition

A custodial wallet is a cryptocurrency wallet where a third-party service provider, or custodian, holds the private keys controlling access to the cryptocurrency instead of the wallet owner. Cryptocurrency exchanges and trading platforms often use custodial wallets for managing large amounts of cryptocurrency for multiple users. They can also provide extra security features, like multi-factor authentication and cold storage.

On the other hand, a non-custodial wallet serves as a digital storage solution for cryptocurrencies or digital assets, granting users complete control over their private keys and funds. Unlike custodial wallets, wallet service providers cannot access these private keys, ensuring users fully own their assets.

Custodial vs Non-Custodial Wallet

The key distinction between a custodial vs non-custodial wallet is the user’s control and responsibility for their funds. With non-custodial wallets, users maintain full control over their funds and must secure and back up their private keys. On the other hand, custodial wallets entrust a third-party service provider with the wallet’s security and management.

The choice between a custodial or non-custodial wallet depends on personal preferences and priorities, taking into account security, convenience, and usability.

| Feature | Custodial Wallets | Non-Custodial Wallets |

|---|---|---|

| Private Key | Third-party | Wallet holder |

| Accessibility | Registered users | Accessible to anyone |

| Transaction Costs | Typically higher | Typically lower |

| Security | Typically lower | Typically higher |

| Support | Typically higher | Typically lower |

| KYC Requirements | Yes | No |

Are Custodial Wallets Safe?

Custodial wallets can be safe if managed by reputable and trustworthy custodians. However, risks include insider theft, hacking, and changes in the custodian’s policies or terms of service. To minimize these risks, choose a custodial wallet provider with a strong reputation, and practice good account security like using two-factor authentication or three-factor authentication.

Non-Custodial Wallets: Are They Safe?

Non-custodial wallets, or self-custody wallets, give users complete control over their cryptocurrency holdings. These wallets come in various forms, including browser-based, mobile, and hardware wallets. Non-custodial wallets are generally considered safe, but users are responsible for managing their private keys and seed phrases securely.

Pros and Cons of Custodial Wallets

Pros:

Custodial wallets offer several advantages, including:

- Ease of use: User-friendly interfaces and simple navigation make them suitable for crypto beginners.

- Customer support: Custodial wallet providers assist with resolving issues and answering questions.

- Recovery options: Custodial wallets often have recovery mechanisms to retrieve funds if you lose access.

- Integrated services: Many custodial wallets link to exchanges or services for easy crypto trading.

- Enhanced security: Professional teams manage custodial wallets, implementing security measures like multi-factor authentication and regular audits.

- Insurance: Some custodial wallets provide insurance coverage for user funds in case of security breaches or unforeseen events.

Cons:

- Lack of control: Custodial wallets offer limited control, as third-party providers manage private keys. Users must trust these providers for secure asset handling. Non-custodial wallets, however, give users complete control over private keys and ownership of digital assets.

- Risk of hacking and fraud: Custodial wallets are more vulnerable to hacking and fraud due to their centralized nature. Users’ funds could be at risk during security breaches. Non-custodial wallets provide increased security, as users control private keys and store them on their devices or hardware wallets.

- Fees: Custodial wallets typically charge transaction, withdrawal, and conversion fees, which can accumulate over time. Non-custodial wallets generally have lower fees, only charging for network fees necessary to process blockchain transactions.

- Centralized nature: Custodial wallets’ centralized operation may clash with cryptocurrencies’ decentralization principles. Using custodial wallets means sacrificing some independence associated with managing private keys. Non-custodial wallets support decentralization and self-sovereignty by enabling users to remain independent of centralized authorities.

Non-Custodial Wallet Benefits (Pros)

Non-custodial wallets present several advantages, including:

- Security: These wallets provide superior security compared to custodial wallets since users solely control their private keys and store them locally on their devices. This setup minimizes the risk of hacks, thefts, or fund loss due to service provider failure.

- Privacy: Non-custodial wallets offer more privacy as they don’t require personal information like custodial wallets, enabling anonymous use.

- Accessibility: Users enjoy increased accessibility and control over their funds, as they can access them anytime and anywhere with their private keys and an internet connection.

- Independence: These wallets support decentralization and autonomy in financial transactions, eliminating dependence on centralized authorities or service providers.

- No Fees: Non-custodial wallets typically don’t charge fees for their services, apart from network fees needed for processing blockchain transactions. This benefit can lead to cost savings, particularly for frequent cryptocurrency users.

Cons:

Some disadvantages of using non-custodial wallets include:

- Greater responsibility: With full control over your private keys, you are solely responsible for the security and backup of your keys. Losing your private keys or failing to secure them properly can lead to the permanent loss of your funds.

- Limited customer support: Non-custodial wallets often have limited or no customer support. Users are responsible for troubleshooting any issues that arise, which can be challenging for those who are less tech-savvy.

- No recovery options: If you lose access to your non-custodial wallet, such as forgetting your password or losing your backup seed phrase, there is usually no way to recover your funds.

- Technical knowledge required: Non-custodial wallets may require a certain level of technical knowledge to set up and manage, which can be difficult for beginners.

- Less integration with other services: Non-custodial wallets may not be as seamlessly integrated with other services, such as exchanges when compared to custodial wallets. This can make trading or buying cryptocurrencies slightly more cumbersome.

- Risk of human error: With full control over your funds, there is a higher risk of human error, such as sending funds to the wrong address or accidentally exposing your private keys.

- No insurance: Non-custodial wallets generally do not provide insurance coverage for user funds in case of security breaches or other unforeseen events, unlike some custodial wallets.

Non-Custodial Wallet Examples

Various non-custodial wallets are available in the market, including:

MyEtherWallet (MEW)

A popular wallet designed for Ether (ETH) and ERC-20 tokens, MEW allows users to create and manage their wallets. It offers security features like multi-factor authentication, hardware wallet support, and two-factor authentication.

Ledger Nano S

This hardware wallet provides high security for storing cryptocurrencies by enabling users to store private keys offline, protecting them from online attacks.

Exodus

A desktop and mobile wallet that supports multiple cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. Exodus offers a user-friendly interface for managing and trading cryptocurrencies, with security features like password protection and backup seed phrases.

Atomic Wallet

A non-custodial desktop and mobile wallet supporting over 300 cryptocurrencies. Atomic Wallet allows users to store private keys offline and offers features like a built-in exchange, staking, and purchasing cryptocurrencies with a credit card.

Trezor

A hardware wallet supporting multiple cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Trezor stores private keys offline and includes security features such as PIN protection and two-factor authentication.

These examples represent only a few non-custodial wallets available. It’s crucial to research and choose a wallet that aligns with your specific needs and requirements.

Electrum

Electrum is a popular non-custodial wallet designed for Bitcoin users who value security, privacy, and control over their digital assets. Established in 2011, Electrum has been a trusted choice among cryptocurrency enthusiasts due to its robust features and user-friendly interface.

Supported Cryptocurrencies in Custodial Wallets

Custodial wallets usually support many cryptocurrencies, such as Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. The specifically supported cryptocurrencies may vary depending on the provider. Some wallets may also support lesser-known cryptocurrencies or tokens, although availability may be limited.

Binance: Custodial Wallet or Not?

Binance acts as a custodial wallet when users deposit their cryptocurrencies on the platform. However, Binance also offers a non-custodial wallet option, Binance Chain Wallet, which lets users hold their private keys and control their funds directly. This non-custodial wallet is separate from the main Binance platform and requires installing a separate wallet application.

Is MetaMask a custodial wallet?

MetaMask is a non-custodial wallet, not a custodial one. This means users maintain full control over their private keys and must manage and secure their digital assets themselves. Since MetaMask cannot access users’ private keys or funds, it offers enhanced privacy and control for cryptocurrency holders.

Is Coinbase a custodial wallet?

Yes, Coinbase is a custodial wallet. It means the platform holds users’ private keys and manages their digital assets. While this offers convenience and customer support, it also means users rely on Coinbase for the security of their funds.

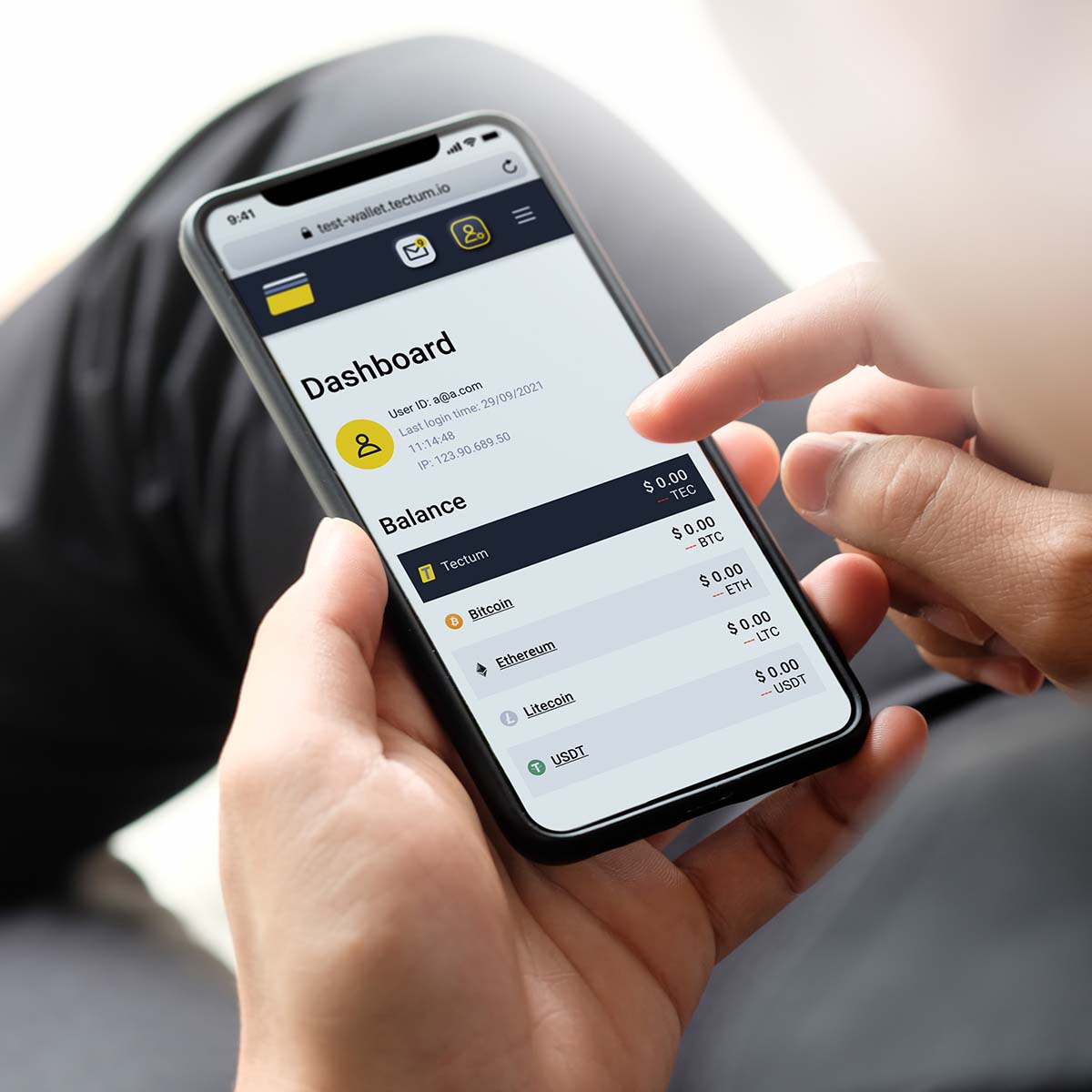

Is Tectum a custodial wallet?

Yes, the Tectum wallet is a custodial wallet. As a custodial service, Tectum holds users’ private keys and manages their digital assets. Although this provides convenience and customer support, it also means users depend on Tectum for their funds’ security.

Choosing the Right Wallet for Your Crypto Assets

Both custodial and non-custodial wallets serve as suitable options for storing crypto assets, including NFTs. Traders and investors often utilize both types according to their needs. Make sure to select a wallet that supports your specific crypto, as compatibility varies.

The choice between custodial and non-custodial wallets depends on your needs. If you prefer full control over your assets or want to interact with DeFi applications using blockchain technology, consider a non-custodial wallet. However, if you seek a service provider to manage storage while you trade or invest, opt for a reliable custodial wallet service.