In the last edition of the Developers Corner series, we announced that we are working on a staking formula. The reason is that Tectum intends to launch another staking exercise by January 2024. This is an excellent opportunity for anyone who wants to make a significant profit, as they will get a 20% interest on their investment. Ahead of the upcoming Tectum Emission Token ($TET) Staking, the team is showing a detailed process of how people can participate.

This article is a detailed overview of everything that people need to know about staking in $TET over an extended period. It will outline the criteria for participation, terms, and conditions. More so, this will also serve as a tutorial to guide people during similar future investment opportunities.

Before explaining $TET staking, we need to refer to the article on cryptocurrency staking. That content explained in entirety what cryptocurrency staking is about. Users can also refer to a recent blog post on how to make the right cryptocurrency investment decisions. These articles are essential preliminaries to give you capitalists a wholesome idea of what investing in cryptocurrency entails. This will help them prepare for and mitigate possible risks.

What is Tectum Emission Token ($TET) Staking?

Tectum Emission Token Staking is the process of locking $TET via a smart contract over a specific period. This ranges from as little as 60 to as long as 180 days. Within this time frame, individuals will not be able to withdraw or spend their tokens. Furthermore, the smart contract daily calculates and accumulates the profits as specific in the agreement.

Once the staking cycle is complete, the system unlocks the tokens, and individuals can access their capital and the accused interest. The process is very similar to staking from a noncustodial wallet or decentralized exchange’s staking pool.

For a better understanding, think of it as signing an agreement with a bank to invest your money for you and give you guaranteed returns. Part of the contract states that you cannot access your capital within the duration of that investment. At the end of the agreed time, you get a specified profit along with your initial deposit.

Models and Types of Tectum Emission Token Staking

If you read through the general staking article and compare it to the definition above, it is obvious that they are very similar. The difference comes into play in the types or models of Tectum Emission Token staking. Most cryptocurrencies use a standard approach where people participate individually and lock their crypto into designated smart contracts. There is little to no room for making choices of some sort.

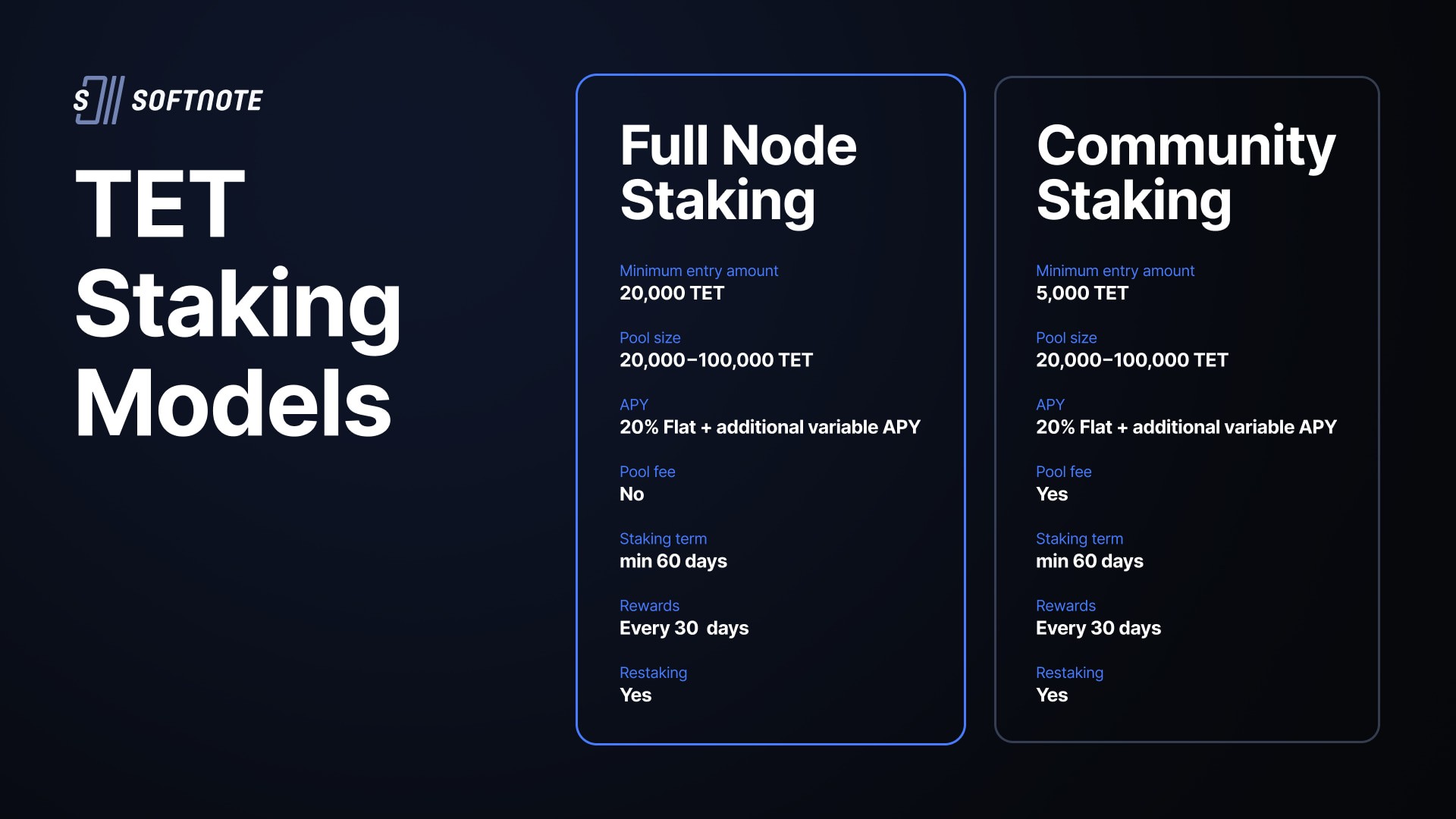

With Tectum, the process is different, and there are two ways to stake your $TET token. The subheadings below explain the different forms, eligibility for participation, and staking process.

Full Node Staking

The Full Node Staking form of Tectum Emission Token staking is a format that most people who are into crypto investment understand. This model is very simple and only requires individual contribution. To participate, an investor simply inputs the amount they want to invest – this is subject to a minimum requirement. While the minimum threshold for individual investment is 20,000 $TET, people can invest more.

To stake their tokens, the user must lock these assets into a smart contract for 60, 90, 120, or 180 days – as they prefer. Within this period, the capital will accumulate a 20% interest. In addition, the funds will be frozen, and individuals will not be able to withdraw or spend their $TET. Regardless of the period that stakeholders choose, their interest will be disbursed every 30 days.

The day after the 30th day, people have the option to withdraw their reward over the last 30 days. Kindly note that the withdrawable amount is the reward and not the capital. Furthermore, people can decide against withdrawing their interest from the last 30 days. The reward will be automatically added to their capital and increase the returns for the next 30 days.

Meanwhile, Tectum is granting bonuses to individuals who lock their tokens and do not withdraw them for an extended period during this staking exercise. Individuals who lock up their funds for at least specific days will get an extra percentage on the initial 20% APY. These benefits apply to other categories in the community pool.

Here is a breakdown of the locking bonuses:

- 60 days – 10%

- 90 days – 15%

- 120-180 days -20%

Full Node Staking:

- Users with 20000 $TET or more can create individual staking pools.

- Receive 10%, 15% or 20% annual interest.

- Staking term: from 60 to 180 days (60, 90, 120, 180).

- TET is frozen for the entire term.

- Rewards are received every 30 days. The day after the accrual date, the stakeholder can withdraw the interest to their address.

- If the rewards are not withdrawn, they remain in the pool account and are added to the next 30-day reward calculation.

Community Pool

The community pool type of Tectum Emission Token staking has a different dynamic to the individual pool. This is because several investors will be combining their resources together to stake in a joint pool. Considering this factor, there will be a few changes.

Tectum Emission Token Staking Validators

To become a validator and create a collective pool, users must hold at least 5,000 $TET. After becoming a validator, individuals must create the collective pool within 7 days. Therefore, it is smarter to have an arrangement with people who can pool the 20,000 $TET already before becoming a validator. Having a group in place facilitates the formation of a community pool, and people can get everything in place within the specified time.

The team is emphasizing the need for meeting this deadline as it is an essential part of the community staking. Failure to create the required collective pool will result in a refund of tokens. This implies that groups will have to begin the process afresh if they do not fill out their quota on time.

- Users from 5000 TET can become validators and create collective pools.

- The validator has 7 days to form a pool.

- After forming the pool, validators must get delegators to contribute to the pool till it reaches the 20,000 $TET threshold.

- Tectum will refund all tokens If the pool formation is not completed within 7 days.

- Validators choose a commission for delegates, affecting the pool’s attractiveness.

- The pool yield is 10%, 15%, and 20%, for the staking term is from 60, 90, and 120 to 180 days respectively.

- The standard rules and regulations of the individual pool also apply.

Individual Delegators

Delegators are micro-investors whose portfolios best suit the community pool. These are individuals who have more than 100 $TET but do not have up to 5,000 tokens. Therefore, they can become validators and open community pools. Considering the options, the best approach is to find an existing pool that suits these persons.

They can simply navigate to the staking section and choose a pool that is open or in operation. Before making a selection, users should ensure that they check the details of the pool to be certain it suits them. This is very important because Tectum Emission Token staking is irreversible and investors must wait out the entirety of the lock period.

Profit Sharing Formula For Community Pools

Meanwhile, the individual must hold at least 5,000 $TET to become a validator and initiate the creation of a group. This entitles them to a 3% commission from the entire reward in the staking pool. Here is an illustration showing the calculation for a collective pool with an initial contribution of 5500 TET and a validator commission of 3%:

- The validator initiates the pool with 5500 TET.

- Imagine the total pool size collected is 20000 TET (including the validator’s contribution).

- Assume the annual staking reward is 20% of the total pool size.

- Annual reward: 20% of 20000 TET = 4000 TET.

- Validator receives a 3% commission from the reward, i.e., 3% of 4000 TET = 120 TET.

- The remaining reward (4000 TET – 120 TET = 3880 TET) is distributed among all pool participants, including the validator.

Understanding the Differences Between the Individual Pool and Community Pool in the Tectum Emission Token Staking

There are various differences and similarities in the individual and community Tectum Emission Token staking pools For a better understanding, the table below will explain them side by size:

| Individual Pool | Community Pool |

| One user stakes 20,000 $TET | One user contributes 5,000 $TET to become a validator and create a community pool |

| No deadline for group formation | The validator must form the group and complete the 20,000 required within 7 days. |

| No need to form a group. | Failure to establish a community pool after 7 days will result in the refund of tokens. |

| The user takes the entire 20% reward | Stakeholders share the 20% reward, with the validator getting a 3% commission from the accrued interest. |

| Users can lock their tokens for 60, 90, 120 and 180 days respectively | Communities can lock their tokens for 60, 90, 120, and 180 days, respectively |

| Individuals cannot withdraw their capital investment during the entirety of the staking duration | Stakeholders in community pools cannot withdraw their capital investment during the entirety of the staking duration |

| Users can withdraw their accrued interest every 30 days | Community pool members can withdraw their accrued interest every 30 days |

| When not withdrawn, interest is added to the capital and increases the reward for the next 30 days | When not withdrawn, interest is added to the capital and increases the reward for the next 30 days |

Benefits of Participating in the Tectum Emission Token Staking

Anyone who is familiar with cryptocurrency investments already knows a few benefits of locking digital assets under a smart contract. However, Tectum Emission Token staking still offers its unique benefits. These incentives are arguably not available in regular staking exercises in both centralized and decentralized platforms.

Some advantages of $TET staking include those stated below:

- Community pool to enable micro investors to participate: as shown above, the joint staking pool ensures that even those who cannot single-handedly fork out 20,000 $TET can partake in this exercise. They can join community pools initiated by validators and still get a decent return on their investment. By lowering the threshold, Tectum ensures that individuals with as little as 1 $TET can join staking pools.

- Standard Sharing Formula to Ensure Transparency: contrary to what is attainable in most other joint staking programs, the reward distribution is very clear. $TET staking comes with a very clear sharing formula that is settled by smart contracts. People do not have to rely on the validator to be fair before receiving their deserved reward. In addition, everyone can see their contribution to the pool and how much each person should receive. Just like the sharing process, distribution is also automated, and the validator cannot restrict contributors from accessing their rewards.

Getting Your Tectum Emission Tokens TET To Participate in a Staking Exercise

Before individuals can stake their $TET, they must have the required amount, and it must be on the right network. , Anyone who wants to buy Tectum Tokens can get them from MEXC, Bitmart, Bitget, Uniswap, and Smardex. After purchasing $TET, ensure to transfer it to your SoftNote Wallet.

To make the tokens eligible for staking, store them on the T12 network, not the ERC-20 or BEP 20 networks. Individuals can do this by migrating their $TET from their SoftNote Wallet. Simply click on the select the specific token and click on “Migrate”. On that page, input the amount of $TET you want to migrate and the corresponding network.

The best part about this process is that individuals do not have to migrate all the tokens they have. They can simply remove the required amount and keep the rest as they want.