CPI vs PPI: Understanding the Relationship between Consumer and Producer Prices

In the world of economics, two acronyms frequently come up when discussing inflation: CPI and PPI. Both of these metrics play a crucial role in measuring the overall health of an economy, and understanding the differences between them can help individuals and businesses make informed decisions.

What is CPI and PPI, and how do they differ from each other?

CPI stands for Consumer Price Index, while PPI stands for Producer Price Index. As their names suggest, CPI measures the change in prices for goods and services that consumers buy, while PPI measures the change in prices for goods and services that producers buy.

CPI and PPI have different weights for the goods and services they measure. CPI includes a basket of goods and services that represent what consumers purchase on a regular basis. This basket includes items such as food, housing, healthcare, transportation, and clothing. PPI, on the other hand, focuses on the costs incurred by producers in creating goods and services, such as raw materials, equipment, and labor.

| Factor | CPI (Consumer Price Index) | PPI (Producer Price Index) |

|---|---|---|

| Definition | Measures the change in prices for goods and services that consumers buy | Measures the change in prices for goods and services that producers buy |

| Weights | Based on a basket of goods and services that consumers purchase regularly | Based on costs incurred by producers in creating goods and services |

| Examples of Items Measured | Food, housing, healthcare, transportation, clothing | Raw materials, equipment, labor |

What are the main factors that determine CPI and PPI, and how do they influence each other?

The main factors determining CPI and PPI are as follows:

CPI Factors:

- Changes in consumer demand and supply

- Taxes

- Subsidies

- Government policies

PPI Factors:

- Changes in the costs of production

a. Price of raw materials

b. Labor costs

c. Energy costs

Despite the differences in the factors that influence CPI and PPI, the two indices are still closely related. For instance, if the cost of raw materials increases, producers may increase their prices to maintain their profit margins. This can lead to an increase in CPI, as consumers will have to pay more for the same goods and services. Similarly, if consumer demand decreases, producers may lower their prices, resulting in a decrease in PPI.

What is the relationship between CPI and PPI, and how do they impact the economy?

CPI and PPI are both important indicators of inflation and can impact the economy in various ways. If CPI is rising, it means that consumers are paying more for goods and services, which can reduce their purchasing power and lead to a decrease in consumer spending. On the other hand, if PPI is rising, it means that producers are paying more for the costs of production, which can lead to higher prices for consumers, reduced profit margins for businesses, and potentially, a decrease in economic output.

The relationship between CPI and PPI can also indicate the health of the economy. For example, if PPI is rising faster than CPI, it can indicate that producers are experiencing higher costs of production, which may lead to decreased profits and lower economic growth.

Is PPI or CPI more important?

Both CPI and PPI are important metrics that provide valuable information about the economy. However, depending on the context, one may be more important than the other. For instance, CPI is more relevant to consumers and can indicate changes in purchasing power, while PPI is more relevant to producers and can indicate changes in profit margins.

In conclusion, CPI and PPI are two essential metrics for measuring inflation and understanding the health of the economy. By understanding the differences between them and the relationship between them, individuals and businesses can make informed decisions and adjust their strategies accordingly.

*Note: Sometimes, PPI can be higher than CPI, which may indicate that producers are experiencing higher costs of production than consumers. However, this can also lead to higher prices for consumers and reduced purchasing power, which can impact the economy in the long run.

What is CPI vs PPI vs PCE?

CPI, PPI, and PCE are three different measures of price changes, each with its own focus and purpose. Here’s a brief overview of each measure:

- CPI (Consumer Price Index): CPI measures the average change over time in the prices paid by urban consumers for a basket of goods and services. It is a widely used measure of inflation that helps to track changes in the cost of living for consumers.

- PPI (Producer Price Index): PPI measures the average change over time in the selling prices received by domestic producers for their output. It tracks changes in the prices of goods and services at the wholesale level, before they reach the final consumer. PPI is often used as a leading indicator of inflation, as changes in producer prices can be passed on to consumers through higher retail prices.

- PCE (Personal Consumption Expenditures): PCE measures the value of goods and services purchased by households. It is used to track changes in consumer spending patterns and is often used to gauge overall economic activity. PCE includes a broader range of goods and services than CPI, such as healthcare and education.

In summary, while CPI, PPI, and PCE all measure price changes, they do so from different perspectives and for different purposes. CPI focuses on consumer prices, PPI focuses on producer prices, and PCE focuses on consumer spending.

How do CPI and PPI affect the cryptocurrency market

CPI and PPI can indirectly impact the cryptocurrency market, but the relationship is complicated and unclear. CPI and PPI measure inflation, which can sway investor sentiment and market dynamics.

- Inflation and store of value: Investors often view cryptocurrencies like Bitcoin as a hedge against inflation. High inflation can erode the value of traditional assets like fiat currencies and bonds, prompting investors to seek alternatives. In these cases, cryptocurrencies may become more appealing, leading to higher demand and possibly higher prices.

- Central bank policies: Central banks may adjust monetary policies in response to rising inflation, such as interest rates, which can impact financial markets, including cryptocurrencies. For example, a central bank raising interest rates to combat inflation can lead to a stronger national currency, making cryptocurrency investments less appealing. On the other hand, a central bank lowering interest rates or engaging in quantitative easing can result in a weaker national currency, making cryptocurrencies more attractive.

- Risk sentiment: Investors often view cryptocurrencies as high-risk, speculative investments. High inflation can make investors more risk-averse and seek safe-haven assets, leading to a decrease in demand for cryptocurrencies. In contrast, during times of low inflation, investors may be more willing to take on risk, potentially increasing demand for cryptocurrencies.

- Correlation with other assets: The cryptocurrency market can also experience an indirect impact from its correlation with other asset classes, such as stocks and commodities. If CPI and PPI data affect these assets, the cryptocurrency market may experience a related effect.

Crypto and the Consumer Price Index (CPI)

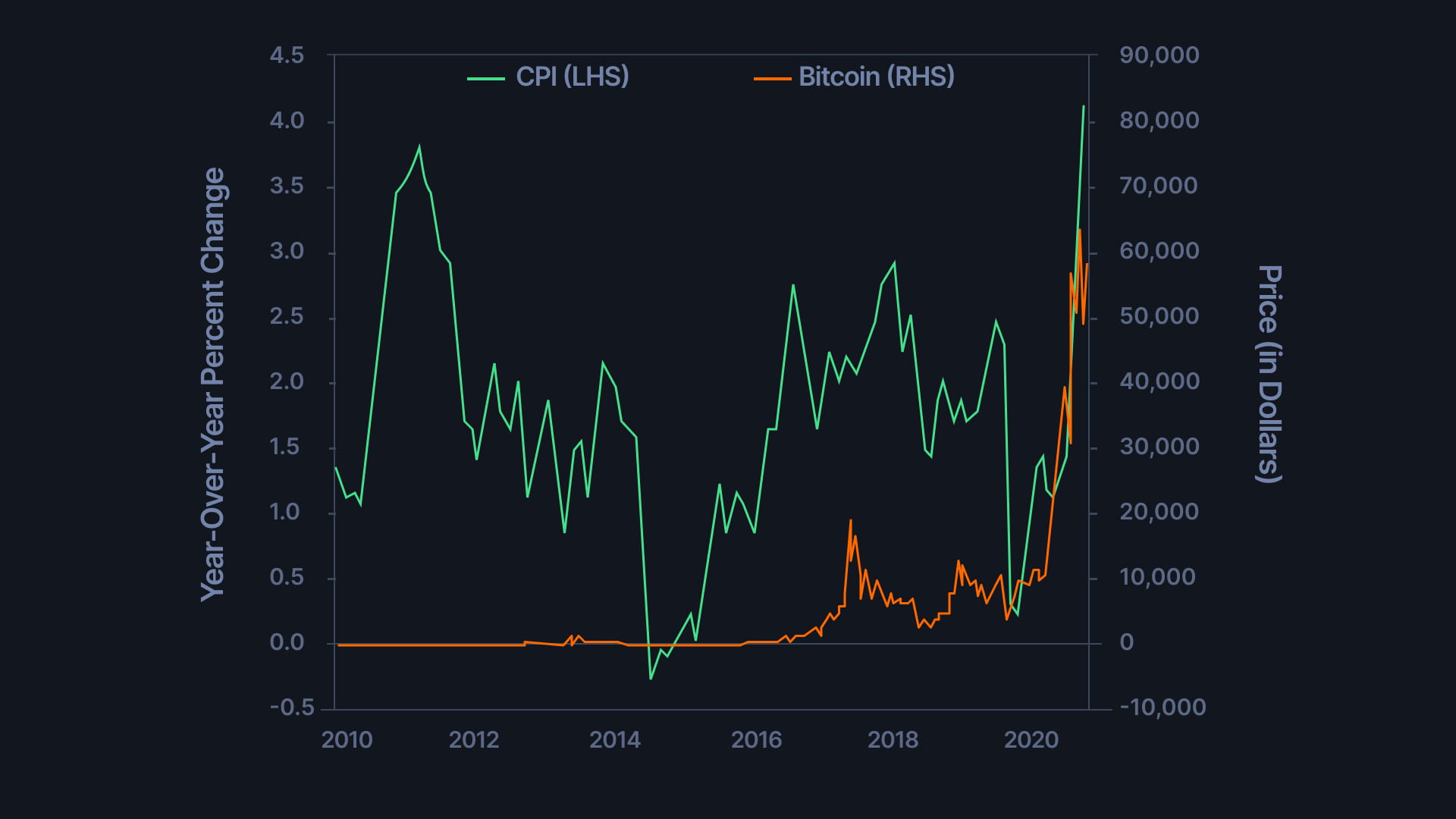

Some people doubt Bitcoin’s role as a store of value and hedge against inflation when considering the CPI. However, the graph indicates a negative correlation, if any, between an increasing CPI and Bitcoin’s price. As consumer prices rise, Bitcoin’s price usually drops, and this holds true for the entire digital asset space.

Price hikes on essential items leave individuals with less disposable income. Since necessities like buying food and paying energy bills take priority over Bitcoin and other cryptocurrencies, it’s natural for people to cut back on cryptocurrency spending and lower their overall exposure to digital assets.

Source: skrill.com

Crypto, Inflation Data, and Monetary Inflation

Monetary inflation, or a growth in the money supply, typically leads to a higher CPI. However, monetary inflation doesn’t reflect the prices consumers and producers pay. Instead, it measures the circulating money supply.

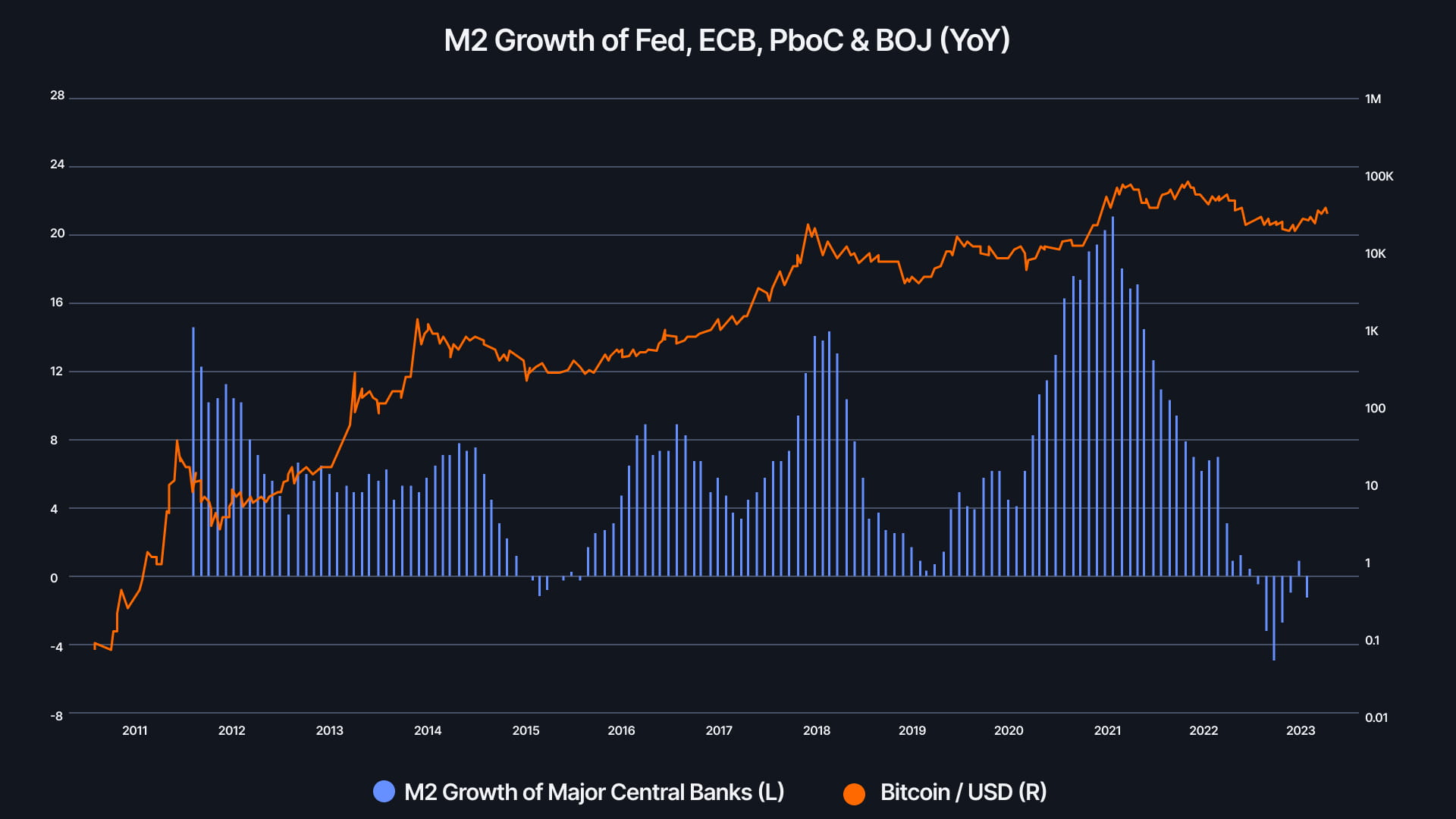

When the M2 supply expands, Bitcoin and crypto often experience significant gains. When it contracts, crypto usually struggles.

The graph below shows that the M2 supply started peaking at the end of 2021 and the beginning of 2022. This timing aligns with the crypto market’s peak last year. The chart below suggests this might not be a coincidence.

Crypto and Inflation Data: Historical Perspective

Historically, the total crypto market cap has grown with an increasing M2 supply and contracted with a decreasing one. In other words, crypto serves as a hedge against monetary inflation. When the money supply starts to expand again, we can expect the crypto market cap to follow suit.