US cuts rate interest: what does it mean and how does it affect the crypto market – recap

“The US Federal Reserve interest rate cut” – a rational move amid the ongoing tensions on the job market and 2024 presidential elections.

The 2024 US presidential elections and the post-covid era have caused a lot of turmoil and discussion around the future of the US economy. According to a number of media reports, including reputable sources of Arabian Business, on the 18th of September 2024, the US Fed took a forceful step in an attempt to revitalise the local job market and stimulate economic activity in the nation.

“By lowering rates, the Fed can stimulate economic activity, making it cheaper to borrow, or slow economic activity, making credit more expensive, which is a useful strategy to fight inflation.” – comments Mohamed Hashad, Chief Market Strategist of Noor Capital, while explaining the importance of the concept of “regulating the interest rate”.

Mohamed Hashad, Chief Market Strategist, Noor Capital

It is crucial to understand that “the cost of borrowing [from the Federal Government] impacts all areas of investing, purchasing, and savings.”, emphasises Hashad.

However, as the anxiety in traditional stocks builds up, some investors are already seeking alternatives.

Fully secure and state-independent crypto solutions in different cryptocurrencies such as “Bitcoin” and “Ethereum” offer an alternative and are already pushing the world into its adoption.

For example, the UAE government is endorsing business-favourable policies to encourage the crypto-industry to expand its network towards the MENA region. More importantly, the UAE aims to attract crypto-nomads to spend in the UAE.

“One notable factor in the rise [of adoption] of cryptocurrency over the past year is the approval of spot Bitcoin ETFs by the SEC in early January.”

According to Hashad, “Cryptocurrencies have been often viewed as a cure-all for various issues, such as inflation, low interest rates, lack of purchasing power, and devaluation of the dollar.” as a result, larger stock exchanges have already started to offer crypto as one of their products.

The main question is – are the stock exchanges simply trying to accommodate their clients or the rising trend around the acceptance of cryptocurrencies is a money-hungry act to overtake various prominent and successful exchanges and services such as Tectum?

Stock Markets vs Crypto

To answer this question, the Chief Market Strategist of Noor Capital suggests looking at cryptocurrency market dynamics.

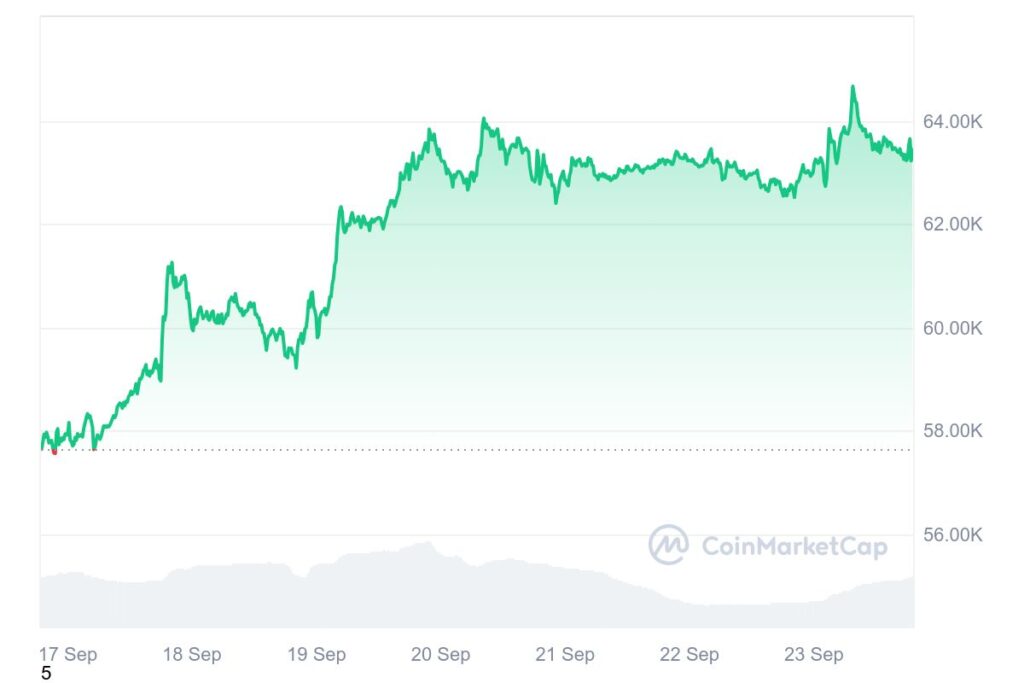

Source: CoinMarketCap

As can be seen from the graph, if Bitcoin was trading at USD 58,967 on Tuesday 17th of September, ever since the US Fed Government dropped its interest on Wednesday the 18th of September, the Bitcoin price has surged up to USD 63,434 as of on Monday 23rd of September. A considerable gain of 10% in value was defined by its geopolitical independence and global efforts to increase the liquidity of the entire cryptosystem as opposed to traditional currencies that are often regionally dependent.

One of the most prominent projects “SoftNote”, is already merging the concept of digital currencies and physical bills

“Cryptocurrency must be more than just an asset – it should and will be a spendable currency in day-to-day life together with conventional currencies that SoftNote can digitalise.” – proclaims Alex Guseff, the founder and the main architect of SoftNote.

Alex Guseff, Founder of Tectum and the main architect of SoftNote

The main aim behind the “SoftNote” project is to implement digital currencies such as Bitcoin and Ethereum within the traditional payment systems of hard currencies that in its instance – can be digitalised throughout the “SoftNote”.

To achieve this, the SoftNote team developed a revolutionary solution that:

1) Would allow local businesses to adopt the new generation of secure payments

2) Opens a pathway to use the cryptocurrency in day-to-day seamless transactions for every user

3) Does not destroy the notion of conventional physical currency but rather offers a contemporary solution in its “SoftNote” banknotes, merging the cryptocurrencies with digitalising conventional currencies

The success of either of the points would benefit the crypto industry as a whole, offering an option for the users to spend their currency within local outlets immediately boosts the liquidity of crypto thus stepping further into the independent world of Web3.