What is utility in economics and how is it measured?

In economics, utility refers to the satisfaction or benefit that an individual derives from consuming a good or service. It is a subjective measure of the level of satisfaction or happiness that a consumer experiences when they consume a particular product or service.

Utility is typically measured using a hypothetical unit called a “utils.” One utils represents the level of satisfaction or happiness that an individual derives from consuming a particular unit of a good or service. Because utility is subjective, it cannot be directly measured, but it can be inferred from the observable choices and behaviors of consumers.

Economists use several methods to measure utility, including:

- Revealed preference: This method measures utility based on the observed choices that consumers make when faced with different options. By analyzing the choices that consumers make, economists can infer the level of utility that consumers derive from each option.

- Indifference curves: This method uses graphical representations of the choices that consumers make to measure utility. Indifference curves are curves that represent all the combinations of goods that provide the same level of utility to a consumer.

- Surveys and experiments: This method involves directly asking consumers to rate their level of satisfaction or happiness with different goods or services. Surveys and experiments can provide valuable insights into consumer preferences and the factors influencing their utility.

Overall, utility is a crucial concept in economics, as it helps to explain consumer behavior and the choices individuals make in the marketplace. By understanding how consumers derive utility from different goods and services, economists can develop models to predict consumer behavior and inform public policy decisions

How does marginal utility affect customer decision-making?

The law of diminishing marginal utility states that as consumers consume more of a good or service, the additional satisfaction or benefit they derive from each additional unit consumed decreases. This means that consumers are willing to pay less for each additional unit consumed, and they will eventually stop consuming the good or service altogether when the marginal utility becomes negative. This principle has a significant impact on consumer decision-making, as consumers will choose to allocate their limited resources toward goods and services that provide the highest marginal utility

What are the 4 types of utility?

In economics, there are four main types of utility that a consumer can derive from consuming a good or service:

- Form utility: This refers to the value or benefits that a consumer derives from the physical characteristics or form of a product. For example, a well-designed and attractive smartphone may provide form utility to the consumer.

- Time utility: This refers to the value or benefits that a consumer derives from having access to a product or service at a particular time. For example, a grocery store that is open 24/7 may provide time utility to consumers who prefer to shop during non-standard hours.

- Place utility: This refers to the value or benefits that a consumer derives from having access to a product or service at a particular location. For example, a gas station located conveniently along a highway may provide place utility to drivers who need to refuel on a long road trip.

- Possession utility: This refers to the value or benefits that a consumer derives from owning a product or service. For example, a high-end car may provide possession utility to a consumer who enjoys the status and prestige that comes with owning such a vehicle.

These four types of utility are important concepts for marketers to understand because they can influence consumer behavior and demand for a product or service. By identifying which types of utility are most important to their target customers, marketers can better position their products or services to meet the needs and preferences of consumers.

What are the 4 characteristics of utility in economics?

The four main characteristics of utility in economics are:

- Utility is subjective: Utility is a personal experience that varies from person to person. What one person finds useful or valuable may not be the same for another person.

- Utility is difficult to measure: Since utility is a subjective experience, it is difficult to measure objectively. Economists use various tools and techniques to try to measure utility, but there is no single, precise way to do so.

- Utility is ordinal: Utility can be ranked or ordered, but it cannot be measured in absolute terms. For example, a consumer may prefer one good over another, but it is difficult to say by how much or quantify the difference.

- Utility diminishes as consumption increases: The law of diminishing marginal utility states that as consumers consume more of a good or service, the additional satisfaction or benefit they derive from each additional unit consumed decreases. In other words, the more you consume of a good or service, the less utility you get from each additional unit consumed.

What is the difference between total utility and marginal utility?

Total utility and marginal utility are two concepts used in economics to explain how consumers derive satisfaction or utility from consuming goods and services. By examining changes in marginal utility and total utility, economists can predict how changes in price, income, or other factors will affect consumer behavior and the demand for goods and services.

Total utility refers to the overall level of satisfaction or happiness that a consumer derives from consuming a certain quantity of a good or service. Marginal utility, on the other hand, refers to the additional satisfaction or benefit that a consumer receives from consuming one additional unit of a good or service – because the additional benefit or satisfaction from each unit consumed tends to diminish.

Total Utility (TU) = U1 + U2 + U3 + … + Un

Marginal Utility (MU) = ΔTotal Utility / ΔQuantity

Marginal Utility (MU) = TU(n) – TU(n-1)

The key difference between total utility and marginal utility is that total utility measures the overall level of satisfaction or happiness that a consumer derives from consuming a particular quantity of a good or service, while marginal utility measures the change in satisfaction or happiness that results from consuming one additional unit of the good or service.

Tokenomics: Unleashing the Power of Utility Tokens for Business Growth

Economic utility and tokenomics unite in the captivating realm of digital assets, forging a new frontier for businesses and consumers alike. Tokenomics, or token economics, directs the creation, distribution, and management of digital tokens, while economic utility signifies the satisfaction or benefit obtained from consuming goods or services. By integrating these concepts, businesses can leverage the power of utility tokens to enhance their operations, incentivize user engagement, and fuel growth in a dynamic, decentralized ecosystem.

Understanding Tokenomics

Tokenomics, or token economics, examines the rules and principles that govern the creation, distribution, and management of digital tokens. These tokens can represent various assets, such as utility tokens, which grant users access to specific products or services within a blockchain network or ecosystem.

Incorporating Utility Tokens into Business Processes

Tokenomics, like the Tectum tokenomics, presents a unique opportunity to enhance user experiences and offer incentives for active engagement within a business or platform. Businesses that integrate utility tokens into their operations facilitate access to their offerings, bolster user engagement, and cultivate a dedicated customer base.

For instance, a gaming platform that employs utility tokens for purchasing in-game items or unlocking certain levels or features can elevate player engagement and retention. Using tokens as in-game currency also fosters a secondary market for the tokens, drawing more users and investors.

Utility Tokens in Social Media Platforms

Similarly, a social media platform can use utility tokens to reward proactive users for generating and curating content. Incentivizing engagement amplifies user-generated content, attracts a broader audience, and lures more advertisers, ultimately boosting revenue.

Building Decentralized Ecosystems through Tokenomics

Moreover, tokenomics enables the establishment of decentralized autonomous organizations (DAOs), superior white-labeled exchanges, and token-curated registries (TCRs) based on token incentives and decentralized governance. Such systems enable community-led decision-making, potentially leading to more efficient and transparent management of projects or organizations.

Diving into Diverse Token Economics Models

Choosing the right tokenomics model is essential for any business’s success. Consider these popular models:

-

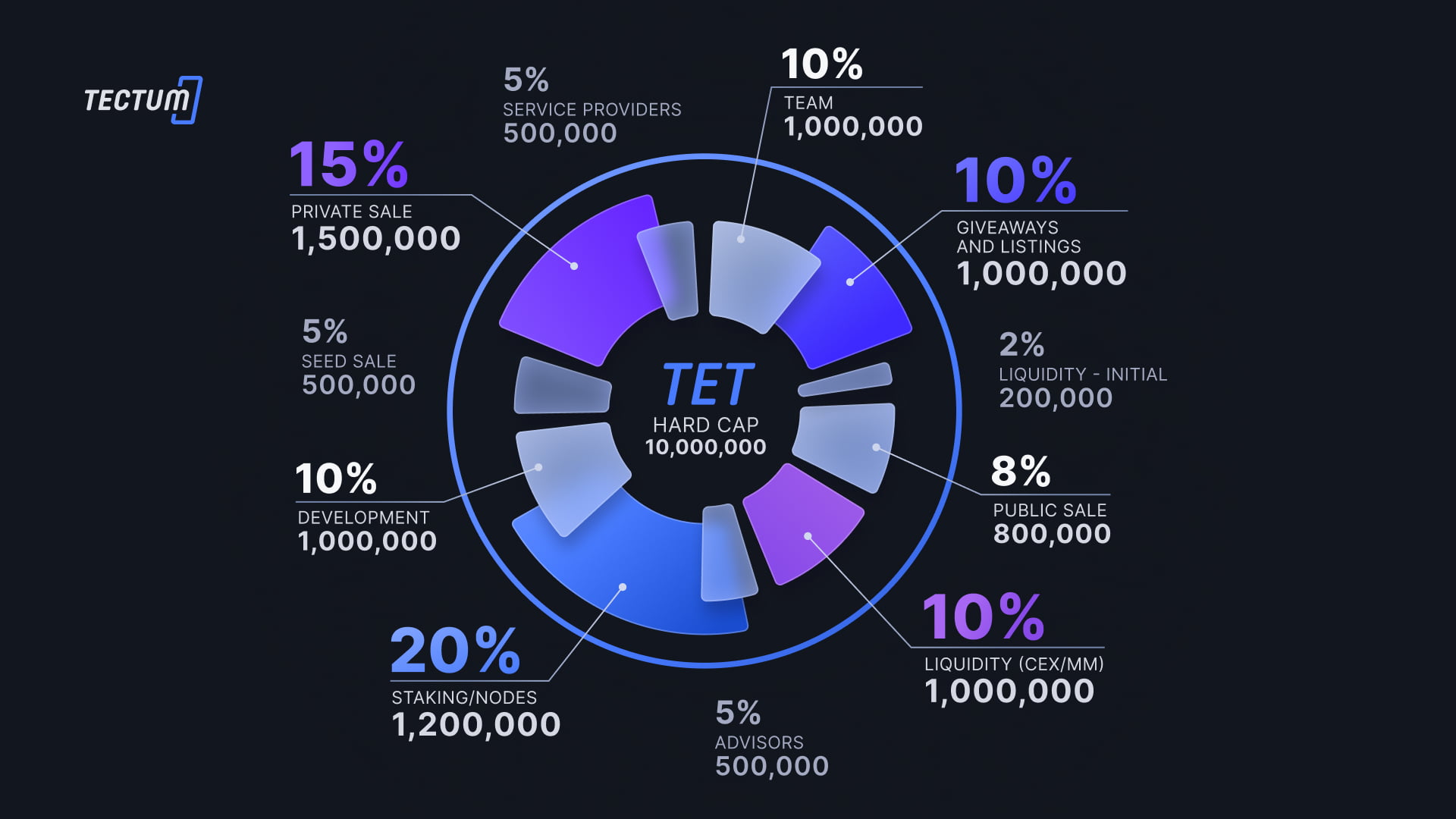

Deflationary Model

The deflationary model, the most common tokenomics model, sets a hard cap on the number of tokens created. For example, the Tectum token (TET) has a hard cap of 10 million. Over time, as the availability of new tokens decreases, demand increases relative to supply. This increase in demand boosts the token’s value and price. However, limited supply may also encourage people to hoard tokens, reducing their utility and value and ultimately hurting the token’s price.

-

Inflationary Model

The inflationary model, resembling the fiat currency economics model, has no limit on token supply. Some startups may limit token creation annually, while others may circulate tokens based on demand. Unlike the deflationary model, no hard cap exists on the number of tokens created. Ethereum is an example of this model.

-

Dual-Token Model

The dual-token model, or “two token model,” involves a project with two tokens: one for utility and another for security. The security token complies with official regulations while raising funds for the project. The utility token allows users to interact with and use the project’s services.

The dual-token model enhances the project’s usability and overall incentivization. Two tokens provide more potential for offering upgrades and features. For example, the blockchain game Axie Infinity uses this model, with Small Love Potion (SLP) as the utility token and their native token AXS as the security token. Players use SLP to purchase in-game assets and complete tasks, while AXS enables voting, trading, and staking.

Despite its benefits, having two tokens can confuse users, making it challenging to differentiate the tokens’ use cases and manage both.

-

Asset-Backed Model

In the asset-backed model, the token is an asset-backed security, with its value determined by an underlying real-world asset with tangible value. For example, Tether claims to be backed by USD.

This model can also be used to sell tangible assets like gold and real estate in the form of tokens. Similar to security tokens, investors gain legal ownership of these assets by purchasing the asset-backed tokens. Due to its connection to the real world, this model is less volatile than others. However, questions about transparency have arisen, as projects claiming to be backed by prestigious assets can be dubious.

Note: When deciding on your tokenomics model, also consider the consensus mechanism you want to implement.

Utility Economics: Conclusion

In summary, tokenomics offers a potent instrument for augmenting user experiences and promoting active involvement in a business or platform. Businesses incorporating utility tokens into their operations foster a devoted customer base and heighten user engagement. With thoughtful implementation, tokenomics can unlock new avenues for user engagement and growth opportunities across various industries.