Is the new US leadership and SEC set to change the nation’s approach to Crypto and if so – what does it take and who is “crypto mama”?

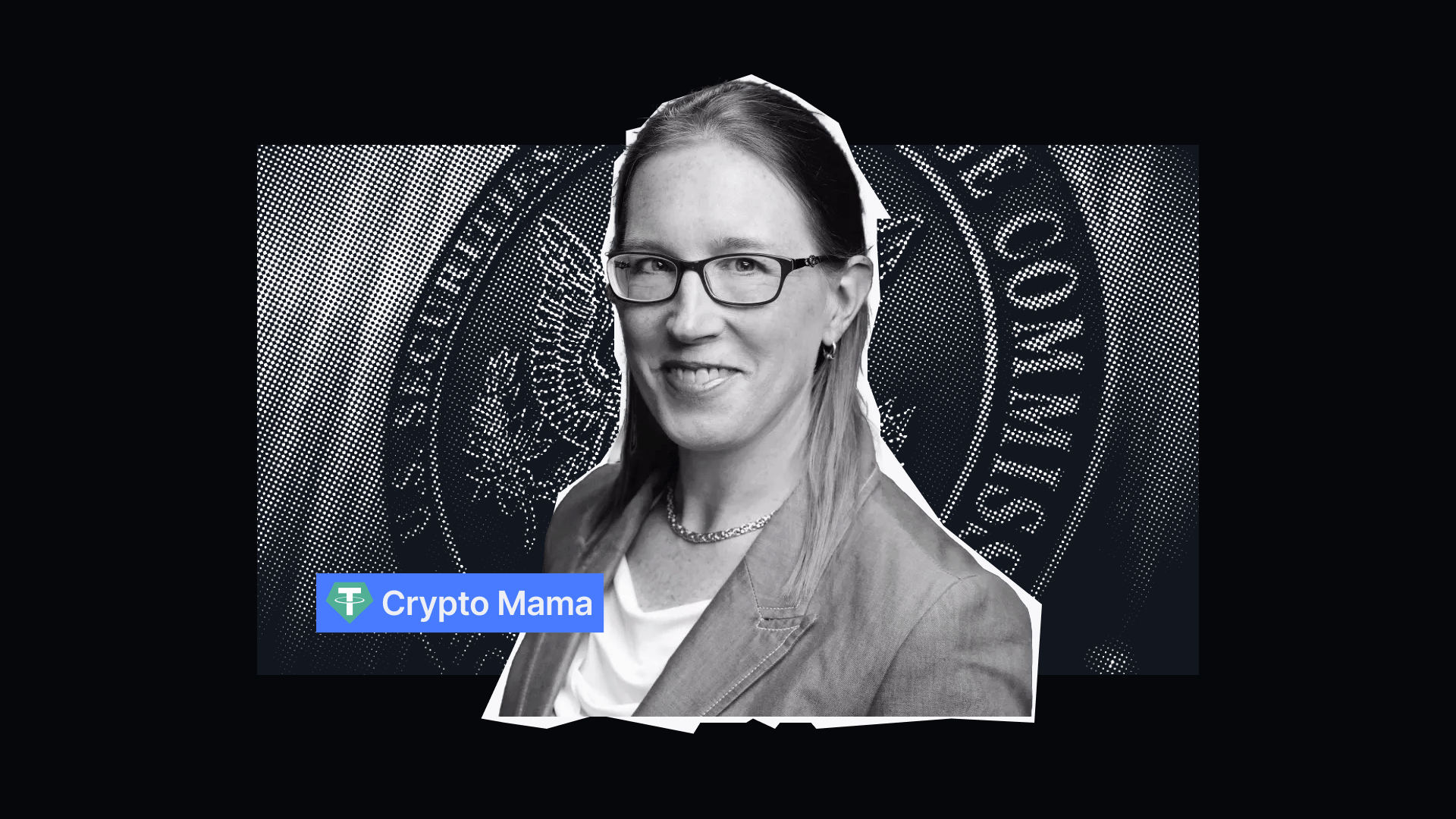

With speculation around SEC Commissioner Hester Peirce possibly stepping up as head of the U.S. SEC, the crypto landscape could see significant regulatory shifts, especially for Bitcoin. Known for her crypto-forward stance, Peirce brings a unique approach to regulation, as highlighted in a recent podcast with Mondaq. Here’s what shall we should expect under her leadership and what it could mean for Bitcoin’s role in the new U.S. economy of Donald Trump.

A “Safe Harbor” for Crypto Innovation

One of Peirce’s standout proposals, the “Safe Harbor” initiative, advocates for a grace period for emerging crypto projects to establish themselves before needing full regulatory compliance. This could mean an era of growth and innovation for the crypto industry, allowing companies more time to refine their technology and business models without immediate and direct SEC intervention. Peirce argues that a clear framework can foster responsible development while protecting investors, potentially making the U.S. a global leader in crypto innovation and challenging the crypto hegemony of Dubai.

Fostering Institutional Trust in Bitcoin

As Bitcoin approaches unprecedented price highs and already hitting 91k, Peirce’s more open approach to regulation could also benefit institutional trust. Hester Peirce has been vocal about Bitcoin’s decentralised nature, which she views as a strength rather than what traditionalists describe as “a regulatory risk”. Her appointment as the head of SEC could lead to faster approval for Bitcoin ETFs, giving mainstream investors a secure path to participate in Bitcoin markets. This shift could signal the U.S. financial system’s growing recognition of Bitcoin as a legitimate asset class, fostering widespread adoption in developed countries and establishing Bitcoin’s “safe to invest” label, similar to how we currently view gold.

Emphasising Consumer Protection and Clarity within SEC

While Peirce is pro-crypto, she does prioritise consumer protection and has expressed the need for transparency from crypto companies. Under her leadership, the SEC could potentially develop guidelines that help investors distinguish between credible projects and high-risk ventures, including the enhanced KYC protection. This balanced approach will provide retail investors with confidence in the market, making Bitcoin investments more accessible and secure for the general public.

Conclusion: A New Era for Bitcoin and Crypto in the U.S.

Last but not least, If Hester Peirce becomes the appointed head of the SEC or how she is often referred as the “crypto mama”, her balanced approach could encourage general Bitcoin adoption worldwide by easing restrictions within one of the world’s main financial markets, in this case – the US, without compromising investor safety. This would benefit not only individual investors but also institutional players, helping Bitcoin solidify its place in the U.S. economy. Peirce’s conversation with Mondaq showcases her perspective on fostering innovation responsibly, pointing to a possible regulatory environment that could make Bitcoin more accessible and accepted across the country.