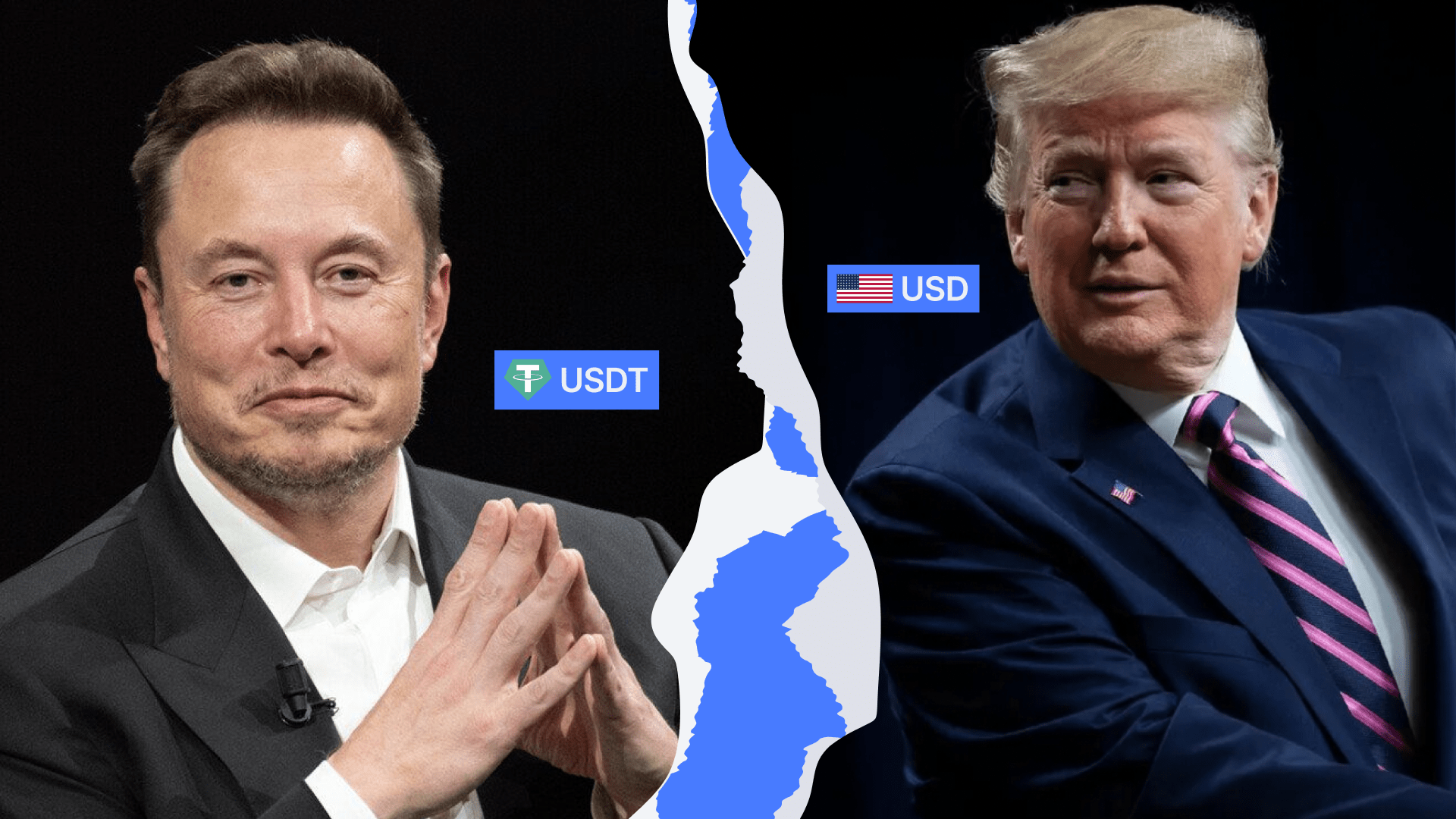

Exploring the Impact of USDT vs USD, Amid Trump’s Return to the White House

Stablecoins Stir Financial Concerns as Trump and Musk Support Crypto

Following Donald Trump’s historic win in the 2024 presidential election, discussions on the future of cryptocurrency in the U.S. have intensified. Trump’s known connection with tech magnate Elon Musk—an outspoken crypto advocate—raises new questions about the potential role of digital assets in America’s financial system. Musk, a proponent of decentralized finance, has endorsed crypto’s transformative potential, while Trump has shown interest in less restrictive business policies, adding momentum to the ongoing debate about crypto’s influence on traditional finance.

USD vs. USDT: Stability vs. Accessibility

The U.S. dollar (USD) maintains its stability through federal backing and is universally accepted. In contrast, Tether (USDT) functions within crypto platforms as a stablecoin designed to mirror USD’s value but excludes government-backed guarantees. This has raised concerns about Tether’s reserve transparency and long-term reliability. Although USDT is widely used within the crypto ecosystem, its value stability is periodically tested, depending on market dynamics and Tether Limited’s management of reserves.

Potential Regulatory Shifts Under Trump’s Leadership

Trump’s potential alignment with Musk’s pro-crypto views could mean a shift in U.S. policy towards digital assets, possibly favouring a lighter regulatory framework. This might ease trading restrictions on stablecoins and reduce compliance requirements, appealing to crypto investors. However, some financial experts argue that relaxing regulations on assets like USDT could introduce new risks to the U.S. economy, where USD remains the cornerstone of global stability. The Biden administration’s push for stablecoin regulation could face a different path under Trump, with Musk’s influence possibly encouraging policies that boost crypto market adoption while addressing stability concerns.

The debate surrounding USD and USDT embodies the struggle between centralised stability and decentralised flexibility. As Trump begins his next term, his administration’s stance on crypto—potentially shaped by Musk’s pro-crypto views—could redefine stablecoin regulation and the role of digital assets in the US. Whether crypto poses a “threat” or an opportunity will depend largely on Trump’s policy directions, which could signal a new era of crypto integration or prompt more concerns against decentralisation.